Written by Carolyn Bailey, Partner, Chief Financial Officer and Chief Compliance Officer of AgIS Capital, LLC

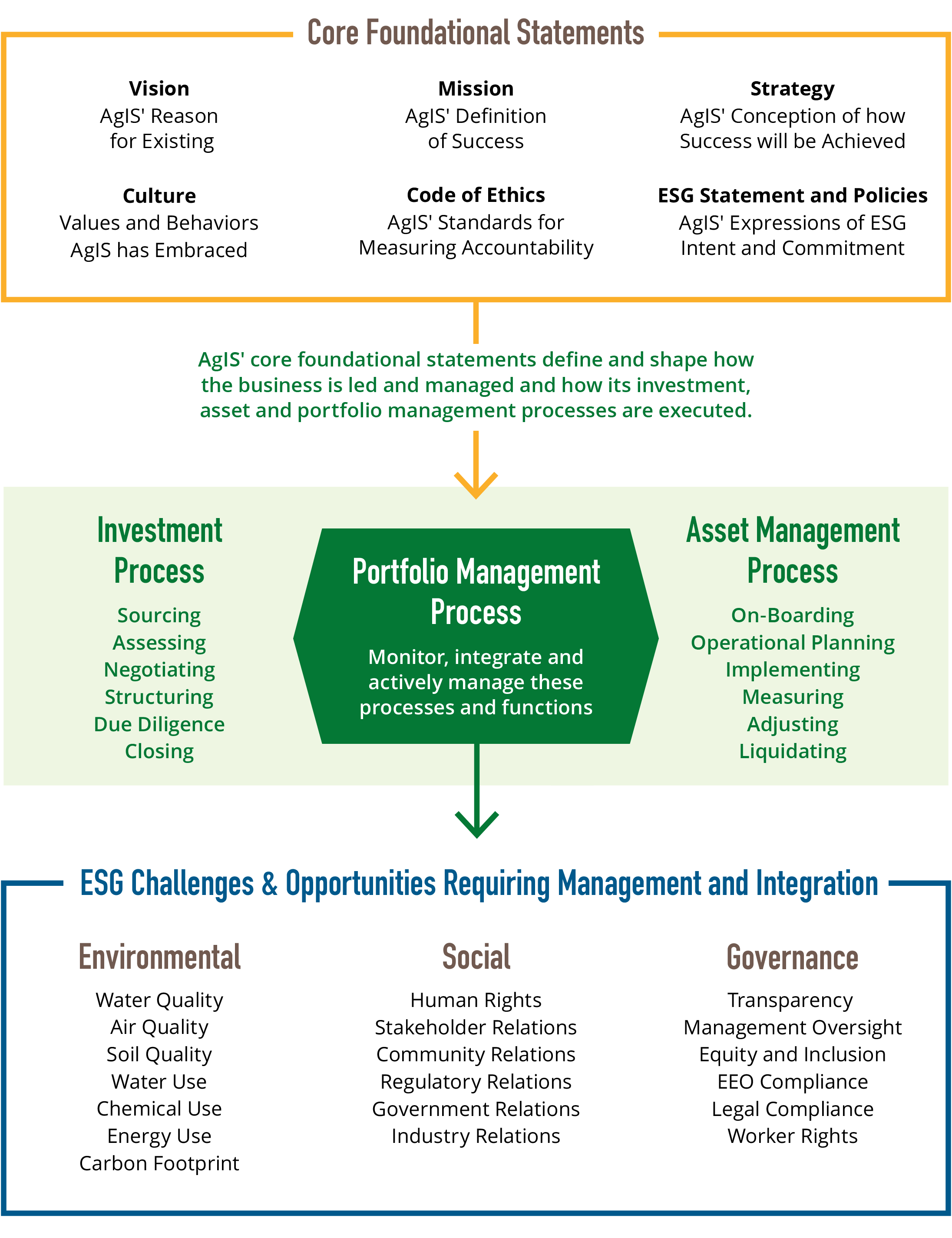

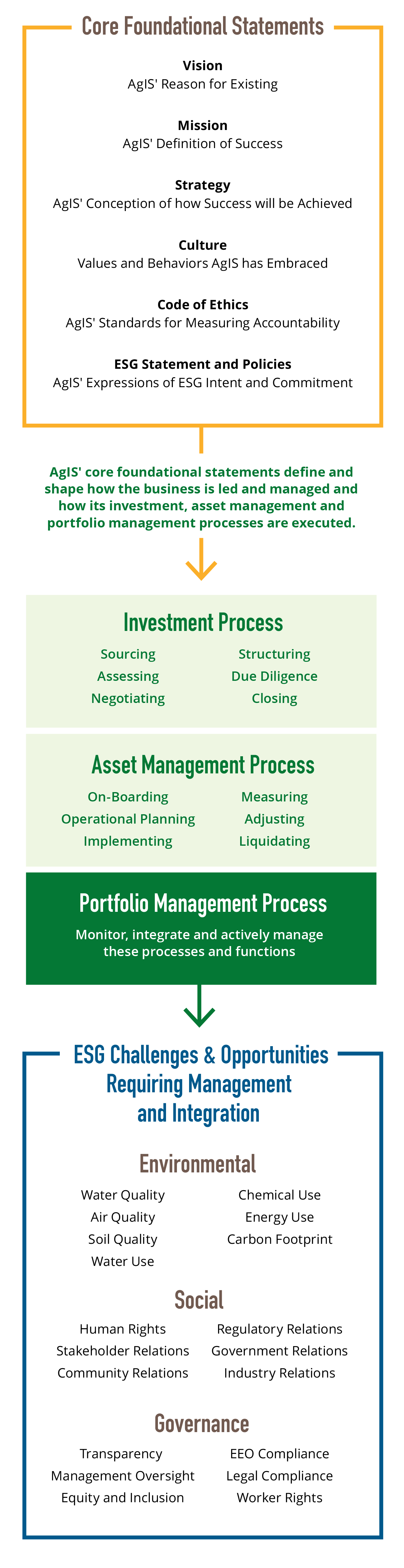

AgIS strives to integrate ESG considerations across the organization to create linkage between our Core Foundational Statements — our Vision, Mission, Strategy, Core Values and Operating Principles — and the three functional areas of the organization — our Investment, Asset Management and Portfolio Management Processes.

ESG Framework

Key Steps of ESG Integration

1. Establishing Our Core Foundational Statements to Reflect our ESG Ethic:

To ensure that we know why we exist, what we are trying to accomplish and how, and what values and behaviors need characterize our approach to business and investing.

2. Adjusting Our Acquisitions/Investment/Portfolio/Asset Management Processes to Accommodate ESG Considerations:

To ensure that ESG issues are recognized and considered at each stage of the investment process — from when we are buying and operating farm assets to how we are managing entire portfolios.

3. Conducting Annual Internal Assessments of ESG Linkage and Integration:

To create opportunities for continuous improvement on the ESG-related dimensions of our business and to accurately report on our activities and efforts to clients and other stakeholders.

4. Participating in ESG Standards Organizations (PRI/Leading Harvest):

To ensure that our work on ESG issues conforms with recognized and endorsed standards of excellence as well as public expectations for firms operating in the agricultural commodity production sector.

5. Engaging in Transparent Public Reporting and Third-Party Auditing on ESG Issues:

To demonstrate our willingness to be held to high standards of ESG engagement and to be recognized for such.

For AgIS, ESG risk and return drivers are integral considerations at every step of the investment process. Learn more about AgIS Capital’s ESG engagement on our Responsibility page.