Experienced and Entrepreneurial

Founded in 2013, AgIS Capital is an independent, employee-owned and operated firm. We work with large, sophisticated institutional investors that share our philosophy about value creation in the agricultural sector. Our partners and staff form one of the most experienced agricultural investment teams in the world.

Experienced and Entrepreneurial

Founded in 2013, AgIS Capital is an independent, employee-owned and operated firm. We work with large, sophisticated institutional investors that share our philosophy about value creation in the agricultural sector. Our partners and staff form one of the most experienced agricultural investment teams in the world.

Generating Superior Performance

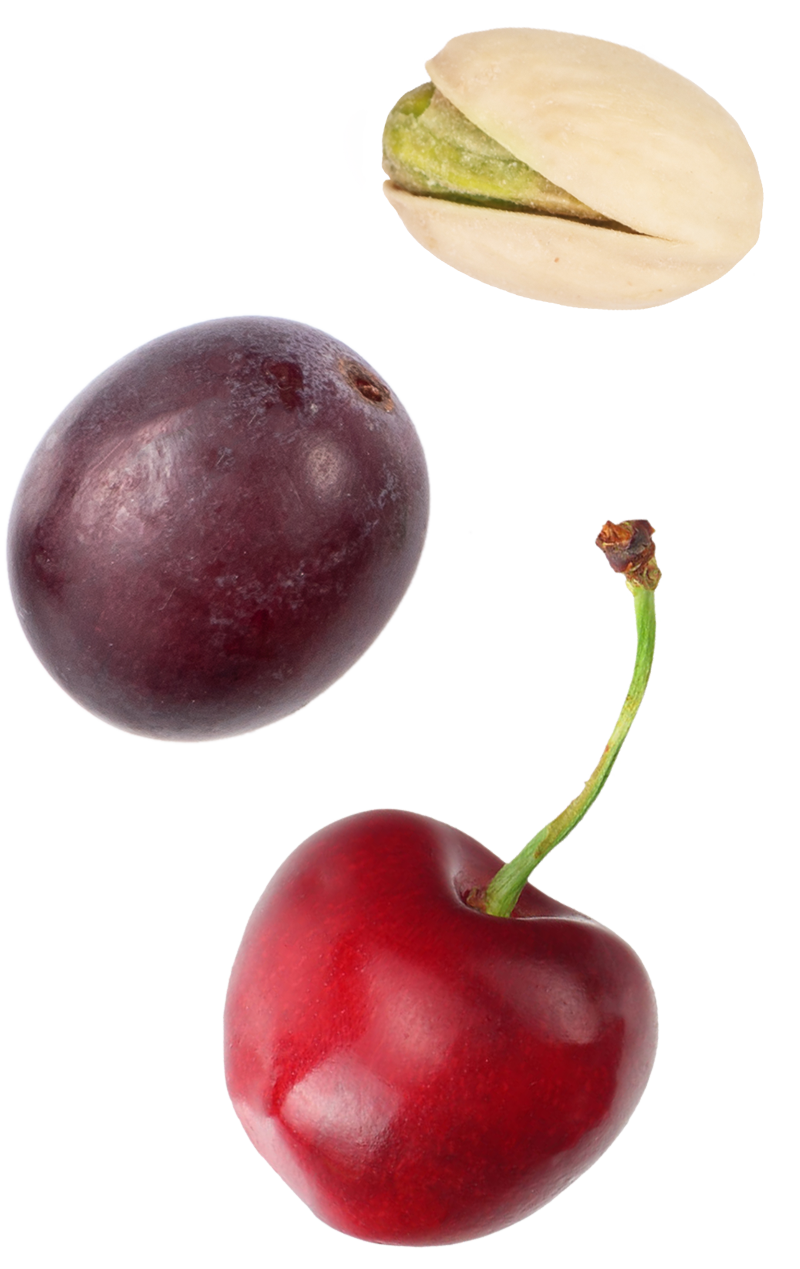

We are focused on generating superior investment performance and strive to be thought leader within the agricultural-investment sector. We concentrate on high-value commodities in major food-producing regions where compelling fundamentals exist.

Transactional Opportunities

We are nimble, flexible and creative in sourcing, analyzing and structuring prospective agricultural transactions. We integrate and synthesize our investment and asset management processes to create and capture new sources of value.

Responsible Investment

We operate without artificially imposed boundaries—investing opportunistically where, when and how it makes sense—and with a high degree of engagement on the sustainability issues that define our business sector.