Transactions

Investing in Agricultural Properties and Related Operating Companies

AgIS Capital is interested in large-scale investment opportunities involving its targeted commodity groups.

Transaction Profiles

ALMONDS AND PISTACHIOS – CALIFORNIA

This transaction involved invested capital of $105 million. It consisted of conventional pistachios and organic almonds. We planted trees in stages over a two-year time frame to transition the commodity profile from a development investment to a mature production asset.

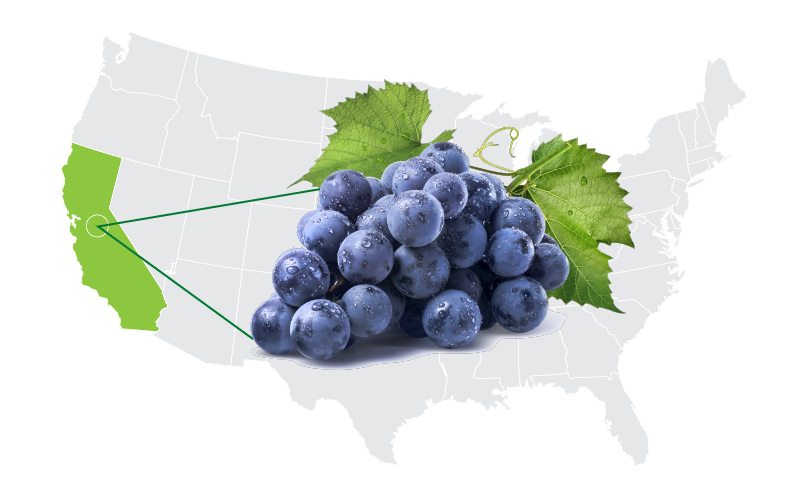

WINE GRAPES – CALIFORNIA

This transaction involved invested capital of $41 million. It consisted of developing a highly productive wine grape asset on converted ranchland. We are growing Cabernet Sauvignon, Petit Syrah, Malbec, Teroldego, Petit Verdot and Sauvignon Blanc grapes to capitalize on the asset’s close proximity to many prestigious American viticultural areas, including Red Hills, Guenoc and Alexander Valley.

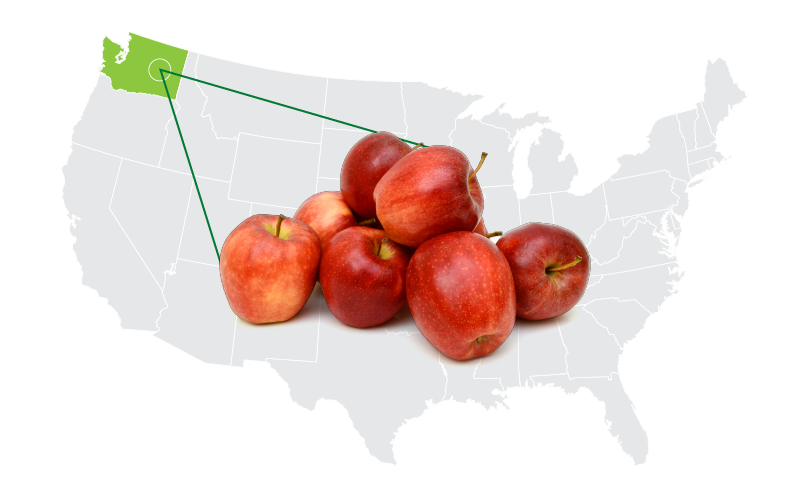

APPLES – WASHINGTON

This transaction in Washington State involved total invested capital of $27 million. It consisted of both conventional and organic apple varieties such as Gala, Honeycrisp, Fuji and Granny Smith as well as both mature and developmental orchards.

ALMONDS AND PISTACHIOS – CALIFORNIA

This transaction involved invested capital of $105 million. It consisted of conventional pistachios and organic almonds. We planted trees in stages over a two-year time frame to transition the commodity profile from a development investment to a mature production asset.

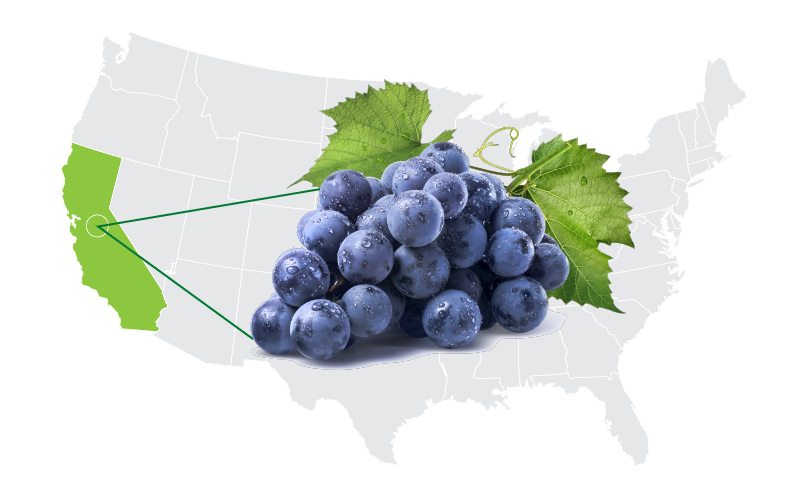

WINE GRAPES – CALIFORNIA

This transaction involved invested capital of $41 million. It consisted of developing a highly productive wine grape asset on converted ranchland. We are growing Cabernet Sauvignon, Petit Syrah, Malbec, Teroldego, Petit Verdot and Sauvignon Blanc grapes to capitalize on the asset’s close proximity to many prestigious American viticultural areas, including Red Hills, Guenoc and Alexander Valley.

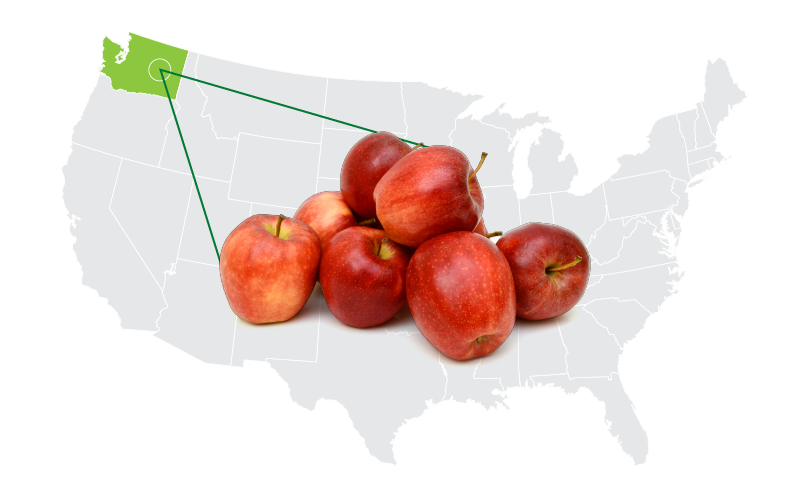

APPLES – WASHINGTON

This transaction in Washington State involved total invested capital of $27 million. It consisted of both conventional and organic apple varieties such as Gala, Honeycrisp, Fuji and Granny Smith as well as both mature and developmental orchards.

To discuss prospective partnering and transactional opportunities with AgIS Capital, please contact: