An article from Perspectives From the Field

Each Spring, Cody Dahl, Ph.D., Vice President, Acquisitions and Strategy, produces AgIS Capital’s State of the Market report to provide analysis of agricultural market dynamics for the benefit of the firm’s investors and friends. Read the report and learn more about Cody’s insights on some key themes and trends and their investment implications.

Each Spring, Cody Dahl, Ph.D., Vice President, Acquisitions and Strategy, produces AgIS Capital’s State of the Market report to provide analysis of agricultural market dynamics for the benefit of the firm’s investors and friends. Read the report and learn more about Cody’s insights on some key themes and trends and their investment implications.

Questions and Answers with Cody Dahl on the State of the Market – Spring 2023

Cody, you outline in the newsletter a number of broad themes concerning the current and evolving state of U.S. agriculture, but what have been the key drivers of investment performance in the sector during the last twelve months?

Cody: The U.S. agricultural economy as a whole has been historically strong and remained so this past spring, but there is reason for us to be cautious about the longer-term outlook. The supply-chain bottlenecks that caused problems for U.S. agricultural producers in recent years have largely been reduced or eliminated, but the U.S. dollar still remains strong relative to other currencies, and this is negatively impacting agricultural exports, particularly for higher-value products like permanent crops.

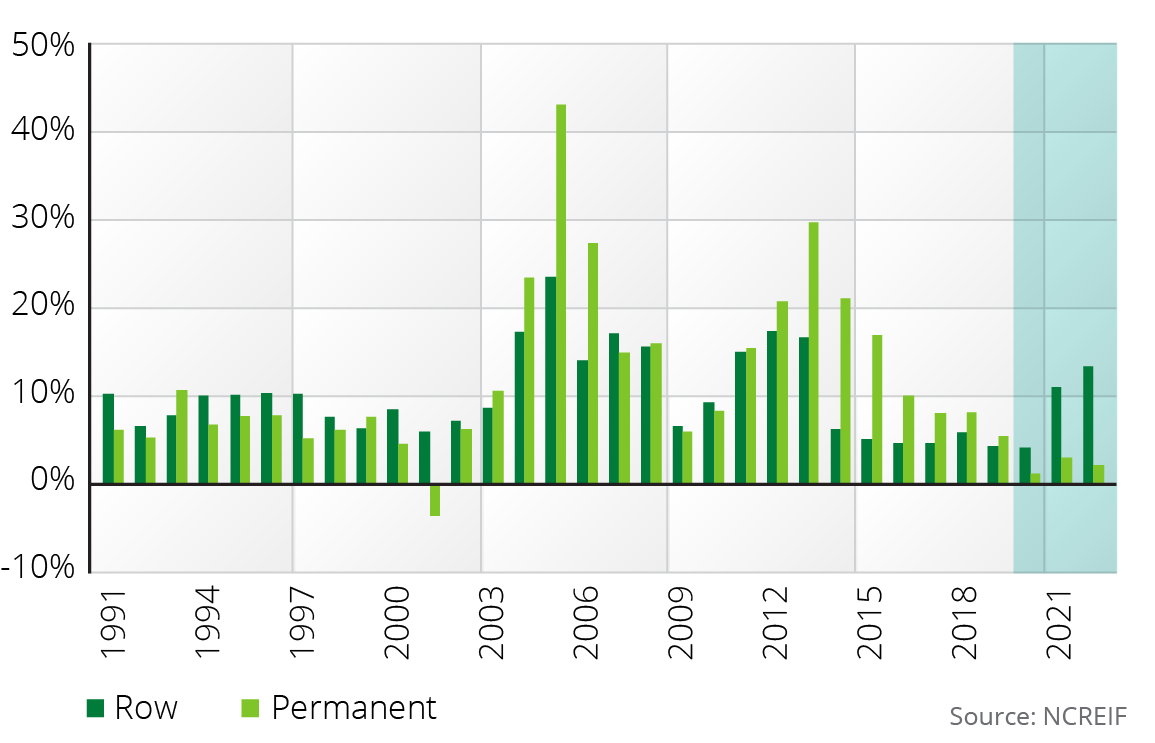

Annual Total Returns for Row and Permanent Cropland: 1991 to 2022

The price of row crop staples, like corn, wheat, rice, and soybeans, have also benefited from Chinese stockpiling, which the Chinese Communist Party (CCP) tends to do in uncertain times. This behavior greatly helped row crop farmers in the past two years and helps explain the discrepancy between row cropland and permanent cropland investment performance. Inflation here in the U.S. also has come down, but it is still a concern, and not knowing what the U.S. Federal Reserve is going to do with respect to additional monetary policy tightening creates uncertainty. This, in turn, has created problems in the banking world, which has led to a challenging borrowing environment that is affecting every element of the economy, including the farm sector. Then there are questions about the outlook for long-term domestic growth and the health of the commercial real estate market, which is dealing with the general economic slowdown and the ways in which the hybrid and remote work trends that took root during the Covid-19 pandemic are influencing both demand for space and lease rates. The point is, the same themes that are creating general instability in the U.S. economy are issues of concern to those of us who are interested in what is happening in the agricultural sector.

“In our view, global geopolitical factors are largely what has driven the uncharacteristically high performance of U.S. row crops, relative to permanent crops, during the last two years, which we believe is unsustainable.”

“In our view, global geopolitical factors are largely what has driven the uncharacteristically high performance of U.S. row crops, relative to permanent crops, during the last two years, which we believe is unsustainable.”

What about offshore forces and their influence?

Cody: In our view, global geopolitical factors are largely what has driven the uncharacteristically high performance of U.S. row crops, relative to permanent crops, during the last two years, which we believe is unsustainable. The war in Ukraine has had a major impact on commodity flows and pricing around the world because it creates supply risks for things like corn and wheat that are produced in large volumes in stable countries like the United States. The war also has had a major impact on fertilizer availability and pricing. Russia is a leading producer of agricultural chemicals. Therefore, the war and the trade restrictions placed on Russia by the West have had an impact on both input costs and farming practices around the world. On top of all that, we have a very unsettled situation in China. As we explain in detail in our State of the Market Report, the CCP has been raising tensions over its regional interest in Taiwan and the United States and other Western countries have been responding forcefully. Obviously, this has had a dampening impact on global relations and trade – including for agricultural products. Furthermore, because of the prolonged Covid-19 lockdowns a dismal credit environment, and a collapsing residential real estate market, among other factors, China’s economy has been in a tailspin.

The CCP knows that angry and hungry people are desperate and that desperate people start revolutions. This is why China’s President, and the Chairman of the CCP, Xi Jinping, has been trying to address these potential threats of social unrest by tightly controlling agricultural policy. In fact, the party has behaved erratically – moving in one direction and then launching new initiatives that are tantamount to initiating 180-degree turns in others. For instance, the CCP has ocellated from enacting unsustainable protectionist measures to enhance rural farm incomes to implementing more free enterprise policies many times since joining the World Trade Organization in 2001. The CCP is obviously trying to balance the benefits of trading with more efficient foreign producers against the consequences of becoming too dependent upon countries it deems adversarial and the potential negative impacts of subjecting millions of rural farmers to market forces that can greatly impact their incomes. The price signals in world markets that result from shifting back and forth from one end of the free enterprise continuum to the other have greatly impacted farming communities across the world. Again, we go into a lot more detail on this in our report, but this background is important to understand if you are investing in U.S. row crops because this, la Nina-induced weather impacts, and the war in Ukraine, are the primary factors that have been driving the strong performance of that sector. However, unpredictable, short-term shifts in the geopolitical climate and within the U.S. domestic economy could change that paradigm very quickly and quite dramatically.

What do you expect this shift to look like?

Cody: An old adage in agriculture goes like this: “High prices cure high prices.” What has happened globally with row crops is that harvested acreage has increased in response to higher prices for corn, soybeans, and other grains and oilseeds, and we see this leading to higher production, which eventually will cause prices to decline. We also think there is a chance that the elevated global prices we have seen for these commodities, and corn, in particular, will result in more production taking place in countries like China, Russia, and Brazil. If this happens, and countries like the U.S., Argentina, and the European Union countries revert to normal production levels, prices, especially for corn, inevitably will move much lower.

AgIS Capital is focused primarily on domestic permanent crop investing – so why has this sector underperformed recently as compared to row crops, and what is your outlook for the future?

Cody: This is true, but we continue to believe permanent crops are a much better long-term bet for investors for a variety of reasons. Let’s start with the influence of China. As I said earlier, the CCP has prioritized building large surplus inventories of essential grains and oilseeds, but it has not done the same with higher-value permanent crops. Consequently, China’s evolving agricultural policies have not benefited global permanent crop prices to the same degree they have influenced demand and pricing for corn, wheat, other grains, and oilseeds. I believe the other major factor right now, as far as permanent crop performance is concerned, is the strength of the U.S. dollar, which makes permanent crop exports from the U.S. less competitive. Looking ahead, I believe the dollar’s relative value will move downward, which should greatly benefit permanent crop performance. Given that permanent cropland capital values have decreased in recent years, permanent cropland investors should be rewarded with higher income levels and stronger capital values when the dollar weakens. In our view, this is why now is a very good time to be invested in permanent crops – or to be looking for opportunities to gain exposure to them.

To learn more about prevailing conditions in the agricultural economy, please read Cody’s State of the Market analysis.