Wine grape investments represent a significant portion of the U.S. permanent crop sector in which institutional investors participate and in recent years the commodity group has generated un-inspiring performance. However, a recent article on winebusiness.com provides a market and trend analysis that offers wine grape investors reasons to be optimistic about the near-term future. The article explains that both wine grape production and pricing, on average, dropped dramatically in 2020.

Historically, the U.S. wine sector has operated on cycles that last between seven and ten years. These cycles generally play out as is illustrated below:

4

Wine grape prices recover and the cycle begins again.

3

Large wineries in need of grapes offer farmers long-term planting contracts (seven to ten years, on average) at higher prices to incentivize them to re-enter the market and increase production.

1

Wine grape prices climb so farmers plant more vines, causing supply to gradually build over the next few years.

2

Wine grape prices recede due to over-supply conditions and farmers begin to remove vines from production due to lack of profitability.

1. Wine grape prices recover and the cycle begins again.

2. Large wineries in need of grapes offer farmers long-term planting contracts (seven to ten years, on average) at higher prices to incentivize them to re-enter the market and increase production.

3. Wine grape prices climb so farmers plant more vines, causing supply to gradually build over the next few years.

4. Wine grape prices recede due to over-supply conditions and farmers begin to remove vines from production due to lack of profitability.

“Even though wine grape returns have been low in recent years, we at AgIS Capital are seeing signs that the market may be stabilizing.”

As the winebusiness.com article explains in detail, wine grape supplies and pricing have dropped dramatically of late. Furthermore, we are seeing large wineries trying to prime growers to increase production by offering them attractively priced, seven-to-ten-year contracts for their grapes.

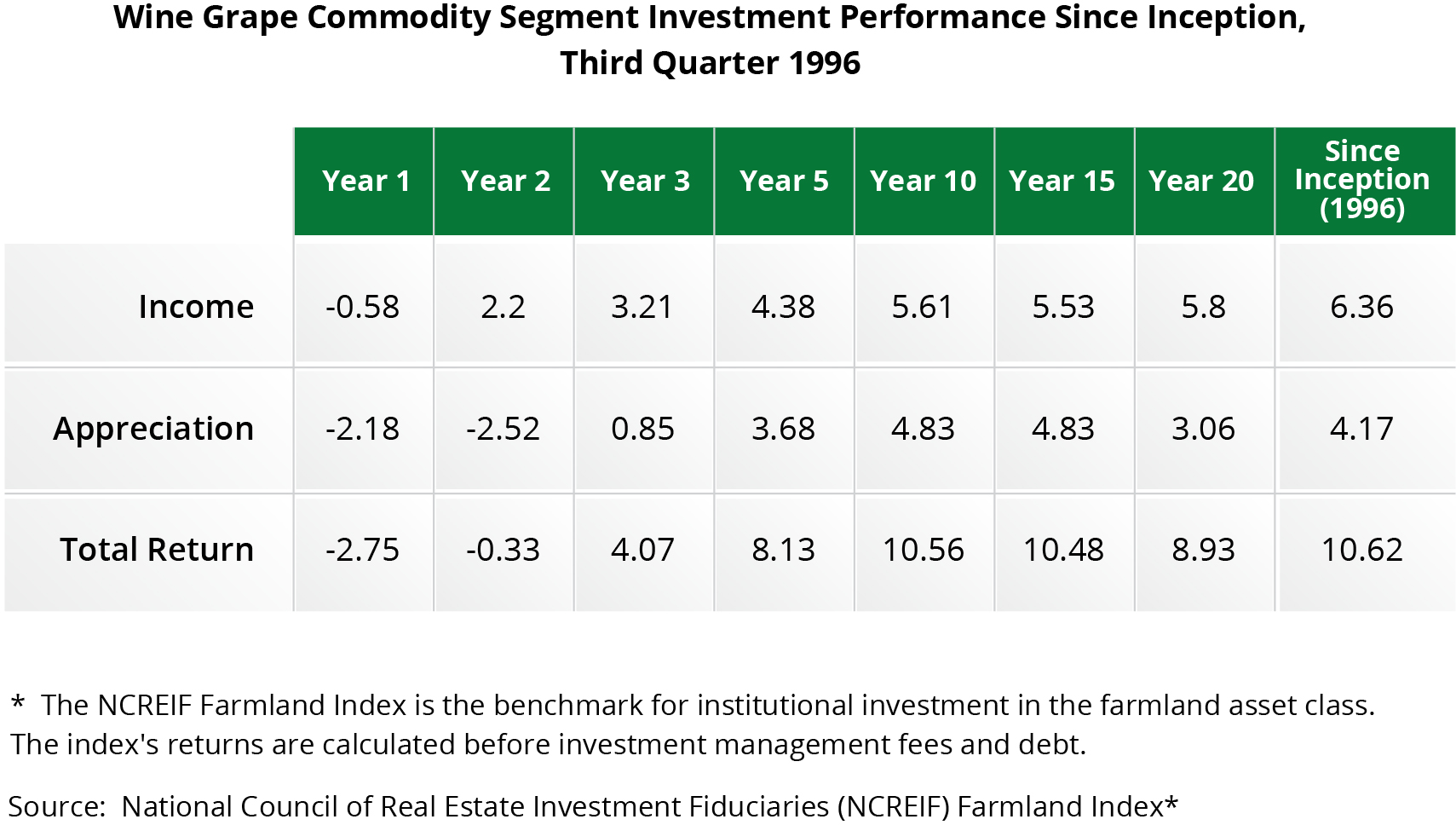

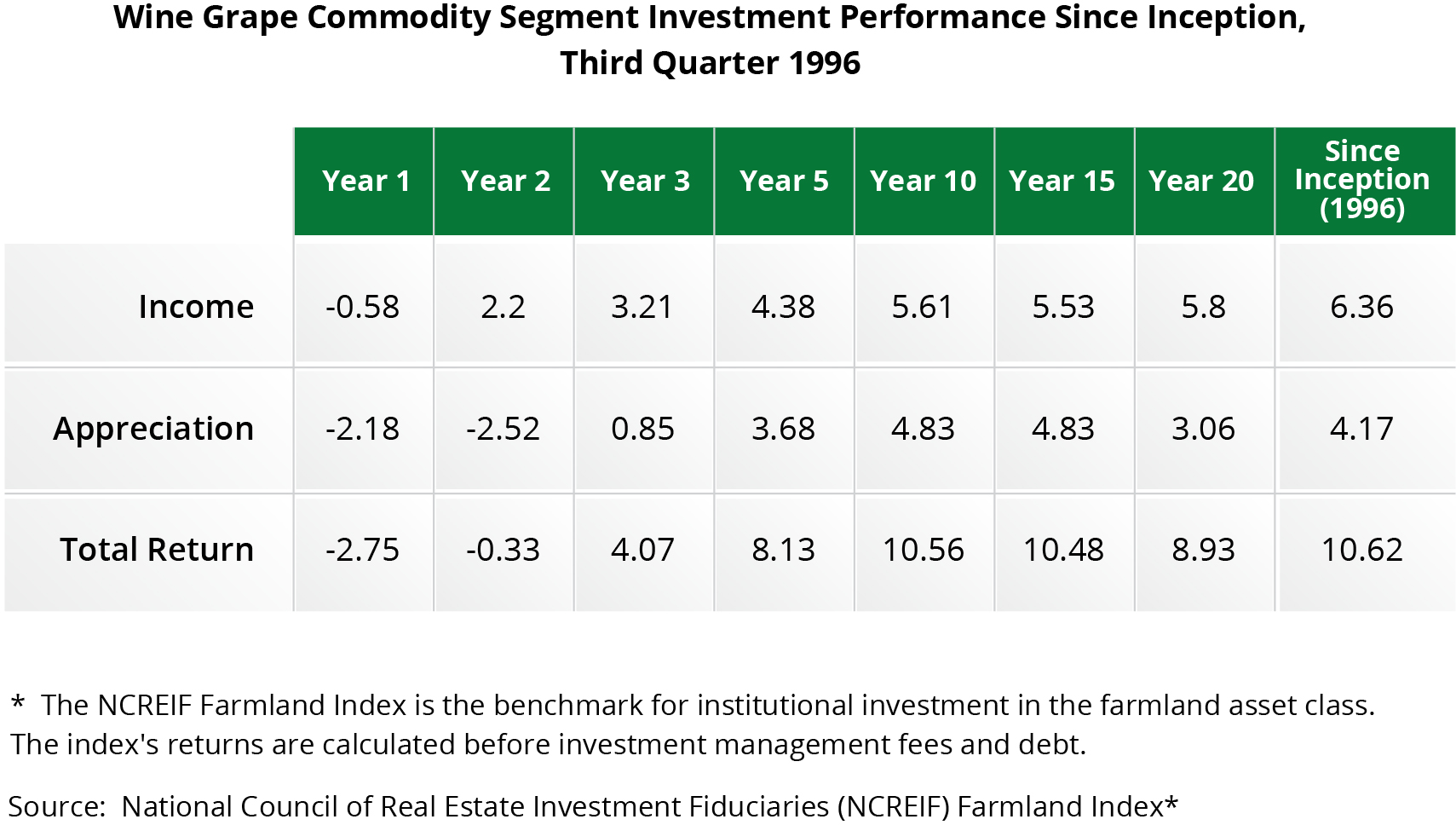

Another indication that conditions may be on the verge of improving is the historical performance of the NCREIF Farmland Index, and specifically the return series for the wine grape commodity segment. Although wine grape returns have been greatly depressed in recent years, the segment has provided investors with attractive, double-digit total returns (10.6 percent annualized) since NCREIF first began tracking wine grape performance during the third quarter of 1996 (See Table Below).

As a general rule, it takes 12 to 18 months, and sometimes even longer, for adverse market conditions to be reflected in the performance of the NCREIF Farmland Index. Based on NCREIF Farmland data, the wine grape segment experienced falling property values in 2019 and 2020 — as well as negative income returns in 2020. These performance metrics are based on appraisals and they suggest that the wine grape segment most recently began to experience weakness beginning in 2018 — if not earlier in some regions. As the linked article indicates, the wine grape segment’s recent struggles have contributed to reduced supplies and falling prices. Over time, we at AgIS believe this reduced supply may result in increased prices, which, in turn, may lead to upward pressure on wine grape property values.

In summary, reduced sector profitability resulting in falling property values, combined with lower inventories and several years of underperformance, suggest the wine grape sector may be poised for a turnaround. Although wine drinking patterns are changing in the United States and internationally, AgIS Capital believes the U.S. wine grape sector continues to be an attractive destination for institutional capital.