An article from Perspectives From the Field

At AgIS Capital, we believe two of our strongest differentiating characteristics are the high levels of commitment our people demonstrate to their work and professions and the degree to which they invest themselves in serving and representing the interests of our clients. To acknowledge their importance to our business, and the value they add for our investors and the agricultural investment sector, we periodically profile members of our team.

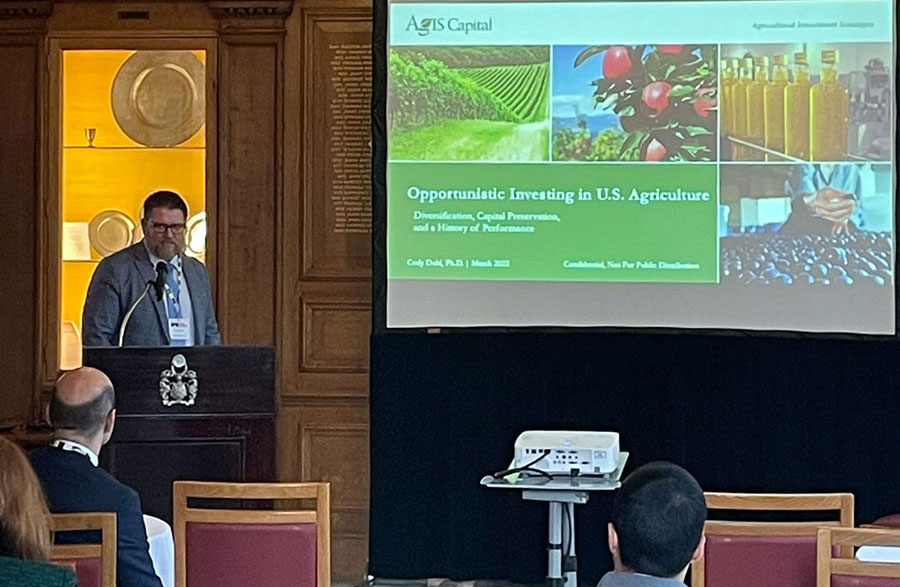

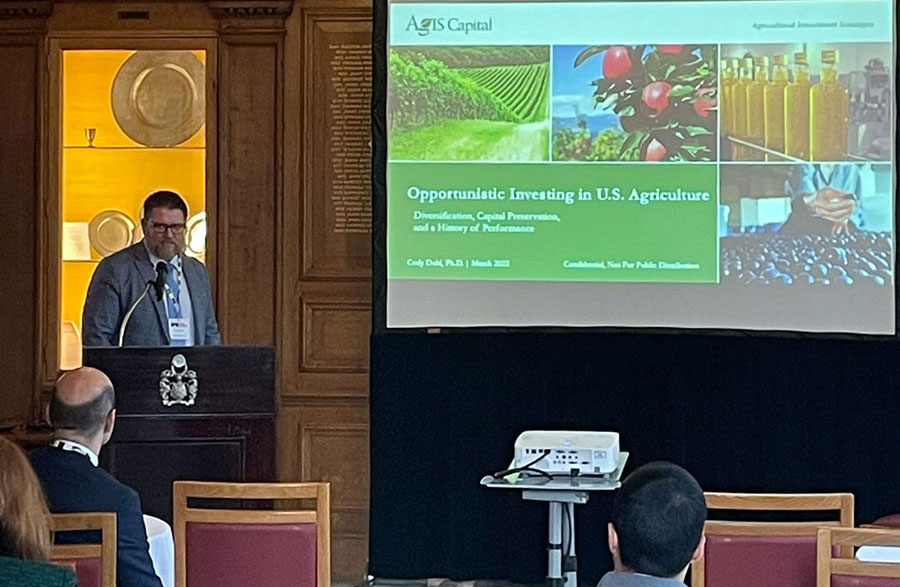

Based at our Tampa, Florida office, Cody Dahl directs economic and agricultural market research for AgIS Capital. He also plays a key role in devising and implementing our investment and portfolio strategies. In addition, he sources and analyzes acquisitions and is frequently the “face of AgIS Capital,” speaking at investor conferences, interfacing with market analysts and academicians, answering questions and fielding inquiries from journalists, and writing on a range of topics germane to our business.

A native of Illinois, Cody and his wife are the parents of two young girls. When he is not analyzing commodity trends or prospective acquisition opportunities for clients, he often can be found spending time with his family – fishing with his wife, coaching his daughters in tennis and soccer, socializing with family and friends, and barbequing for all of them in his backyard.

Based at our Tampa, Florida office, Cody Dahl directs economic and agricultural market research for AgIS Capital. He also plays a key role in devising and implementing our investment and portfolio strategies. In addition, he sources and analyzes acquisitions and is frequently the “face of AgIS Capital,” speaking at investor conferences, interfacing with market analysts and academicians, answering questions and fielding inquiries from journalists, and writing on a range of topics germane to our business. A native of Illinois, Cody and his wife are the parents of two young girls.

When he is not analyzing commodity trends or prospective acquisition opportunities for clients, he often can be found spending time with his family – fishing with his wife, coaching his daughters in tennis and soccer, socializing with family and friends, and barbequing for all of them in his backyard.

Our Conversation with Cody

Tell us about your formative years growing up in Illinois. What was it like? What were your interests?

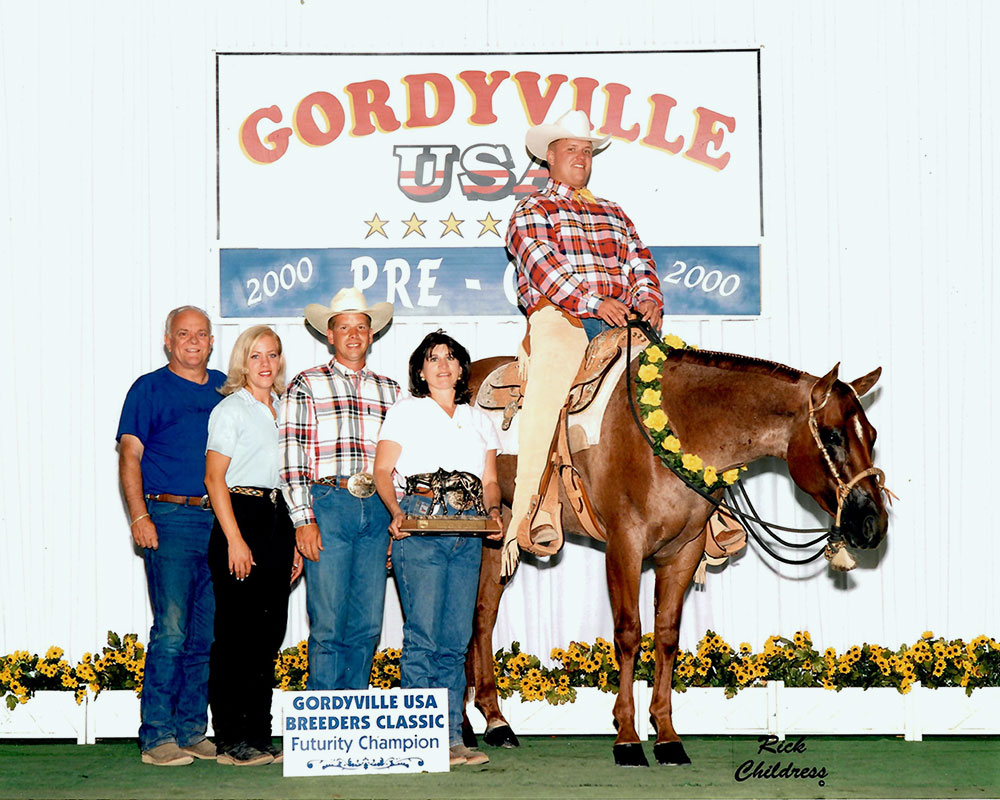

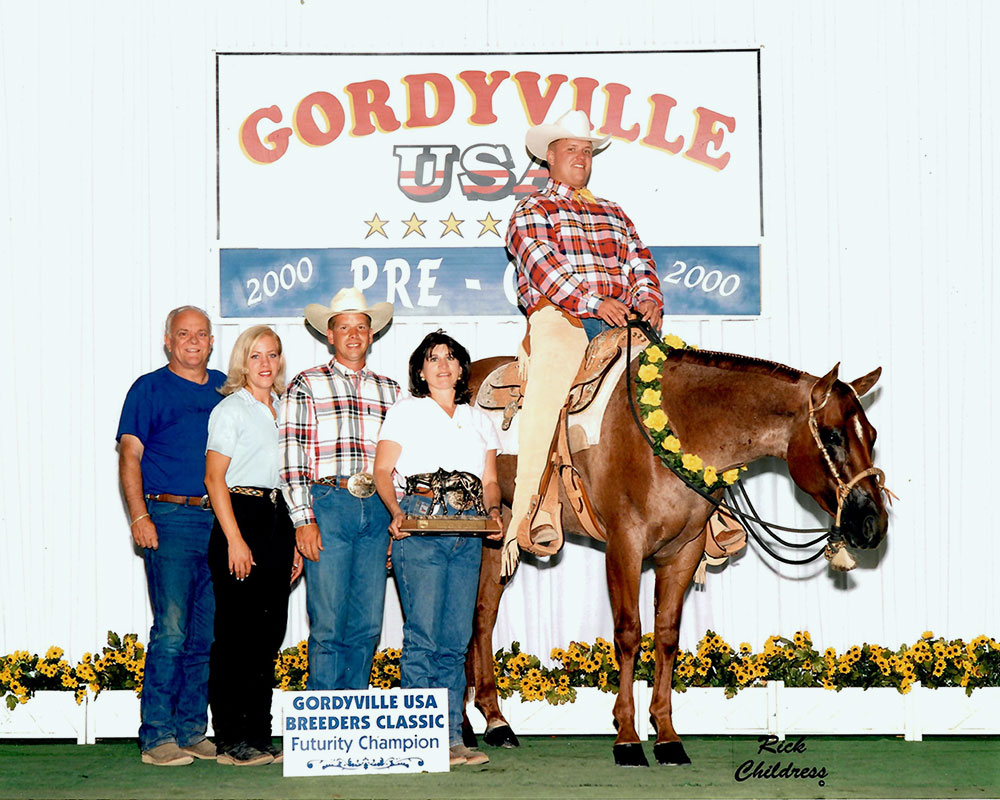

Cody: I grew up in the central part of the state outside of Urbana, Illinois. We had horses and from about the fifth grade on, I spent a lot of my time riding and working with the animals. My high school existence was typical. I loved sports and played football and wrestled. However, I developed back problems (spinal stenosis), so I had to stop participating in both, which was very disappointing. I found myself gravitating back toward working with horses and after graduating early from high school, I went to work with a local horse trainer, which I really enjoyed. Among other things, this included breaking two-year-old horses and training them to show in western pleasure competitions from Michigan to Texas. I was thinking about making a career of horse training, but my father stepped in and told me I really needed to go to college to figure out what I wanted to do with my life. He was a forceful and influential presence – so I listened and enrolled at Black Hawk College, a community college near Kewanee, Illinois.

Where did that lead you next?

Cody: After I finished at Black Hawk College, I went on to study Agribusiness, Farm and Financial Management at the University of Illinois, where I earned my Bachelor of Science degree. From there, I applied to the Master of Agribusiness program in the College of Food and Resource Economics at the University of Florida. They gave me a scholarship so I headed to Gainesville. I loved the program, but a few influential professors convinced me to switch to pursuing a Master of Science degree and to then pursue a doctorate. Ironically, my doctoral committee chair was a professor by the name of Michael Gunderson. He was a recently hired professor and I remember meeting him for the first time. He asked me if Professor Delbert Dahl at the University of Illinois was my uncle. I told him Professor Dahl was my father! It turned out that my Dad had advised Gunderson’s fraternity and Gunderson even took a class with him while he was a student at Illinois – small world!

With a Ph.D. in Agriculture Economics, did you ever think about teaching?

Cody: I thought about it for a fleeting moment, but I decided that I really wanted to work in the investment world. As it turned out, the Hancock Agricultural Investment Group (HAIG) had an open position for an economist and it could not have been a better fit for what I wanted to do. I had my first interview with Jeff Conrad and was really excited about joining the firm. However, he retired shortly thereafter and I ended up being hired by his successor, Oliver Williams. It turned out to be a great experience. I enjoyed working with Oliver and the folks at Hancock, and with Ken Warlick in particular, who oversaw acquisitions. I felt Ken really valued my work and capacity to contribute and I learned a lot from him during that period.

“I liked the idea of working for a smaller, independent investment manager – one that was highly entrepreneurial and where I could contribute in a lot of different ways.”

“I liked the idea of working for a smaller, independent investment manager – one that was highly entrepreneurial and where I could contribute in a lot of different ways.”

So why did you join AgIS Capital?

Cody: Well, about a year or so after he left HAIG, Jeff Conrad became restless and in 2013 he founded AgIS Capital. Shortly thereafter, Ken Warlick, and another colleague whom I admired from HAIG, Carolyn Bailey, joined Jeff as his partners. I had been studying the row crop sector closely and based on recent capital appreciation and commodity-price projections, I had come to believe that the permanent crop arena held more long-term promise for investors. Since that was AgIS Capital’s primary focus, joining the firm was appealing. I also liked the idea of working for a smaller, independent investment manager – one that was highly entrepreneurial and where I could contribute in a lot of different ways. In other words, I saw joining AgIS Capital in 2014 as an opportunity to come in on the ground floor and to work with people who were respected pioneers in the agricultural investing community – and who were working in a segment of the market that I thought held significant, long-term promise.

You mention playing a lot of roles. What does that look like?

Cody: I spend a lot of my time talking with industry participants throughout various stages of commodity supply chains and studying data and big trends to establish our strategic outlook for where markets might be headed and why. We use these analyses and perspectives to formulate and adjust our investment and operating strategies, which allows me to have a meaningful influence over our direction and actions as a firm. I also get to play a key role in sourcing and analyzing acquisitions, working with Ken Warlick and the other members of the Acquisitions Team. This puts me on the front line of AgIS Capital’s approach to investment execution. Finally, I write about my research and often get asked to represent the firm at conferences, in other public forums, in client and prospect meetings, and in responding to inquiries from members of the news media when they are reporting on agricultural investment trends. I value these kinds of interactions because they allow me to learn and be exposed to other points of view.

You seem to enjoy engaging with others. What role does that play in your work?

Cody: I have been told that I have a gregarious personality and I think that is one reason I find the human interaction aspect of my job appealing. I like understanding what interests and motivates people. This is especially important in my acquisitions role because to make a deal work, you not only have to understand what you are trying to accomplish, you need to understand the seller’s goals, too. People talk about “the art of the deal” as if it is some kind of magic formula. To me, it is just having the insight to recognize whether common ground exists between the differing objectives of buyers and sellers. If it does, you usually can get something done. If it does not, it is time to walk away. I think having a lens like this for assessing transactional situations is a key element of successful investing – especially when it comes to hard assets, like farmland.

Where does the curiosity about others come from?

Cody: I think it was the influence of my parents, who I have always tried to emulate. My Dad is someone others gravitate to and I admire that about him. He can walk into a room and without saying a word become the center of attention because of his stature and reputation. I like to think that my ability to connect with people on both a personal and professional level comes from watching how he treats others and how he carries himself. He is genuinely interested in people and that comes through when you meet him. The same is true of my Mom, who is a very caring and compassionate person.

“When you understand the intricacies of a supply chain, you acquire insights about how value is created. This is really what our clients pay us to do.”

“When you understand the intricacies of a supply chain, you acquire insights about how value is created. This is really what our clients pay us to do.”

You seem to have a particular affinity for the intellectual gymnastics associated with analyzing agricultural trends. Why is that?

Cody: Having grown up in an area – Central Illinois – that is dominated by agriculture and agribusiness, I was exposed to their influence on the world and society at a very young age. I find working on land acquisitions stimulating because there are so many variables to analyze and assess before you can move forward with confidence. I also enjoy studying agricultural commodity supply chains – how a crop is grown, harvested, processed, packaged, delivered, and ultimately sold to the end-consumer. When you understand the intricacies of a supply chain, you acquire insights about how value is created. This is really what our clients pay us to do.

What about your investment process at AgIS Capital sets you apart?

Cody: I do not know of another agricultural investment firm that goes as deep as we do with our due diligence, our investment modeling, our budgeting and forecasting, and our operational scenario planning. We understand the investment and operational parameters of every farm asset we manage – and we know what variables we can influence or adjust to make them perform over the long term. This is because of the rigor we impose on our investment process from the outset. We do not look at investment opportunities through “rose-colored glasses.” We are honest and objective with ourselves and we take a disciplined and pragmatic approach to assessing new opportunities and to managing assets that are already under our control. In short, we approach the process of investing our clients’ capital and managing their farms just like we would if they were our own.

Last question… How do you want AgIS Capital to be known and recognized in the marketplace?

Cody: I think every person in our firm would answer that question the same way. We want to be known for our integrity and competence and for our skill and transparency. I think we have a reputation for being a good and highly responsible fiduciary on behalf of our clients. I believe that is because we view them as more than clients… we view them as partners and strive to treat them with the deference and respect that kind of relationship implies. Everything we do – from sourcing acquisitions, conducting due diligence, onboarding assets, and managing them on an ongoing basis, is anchored by what we firmly believe is in our clients’ best interests. That is one reason we like being independent. It prevents us from becoming conflicted – from having to balance the needs and interests of our clients with the business objectives of a parent company. It is also why we utilize co-investment structures to further align our interests with those of our clients. Finally, I think another thing that really distinguishes us is our transparency. We admit our mistakes and hold ourselves accountable. We also learn from both our successes and failures. To me, that is a hallmark of any successful organization and I hope it is always part of our culture here at AgIS Capital.

Related Content